Do you spend countless hours following up (nagging) with your clients?

Do you spend countless hours following up (nagging) with your clients?

In the countless interviews I’ve done with this is one of the top 5 frustrations that financial advisors have. The countless calling, following up with no response, and then calling again to remind them etc. It’s a cycle that most financial advisors have become familiar with. So how we alleviate this problem of lack of engagement and free your time and energy to focus on your priorities such as growing your practice?

Engage Clients

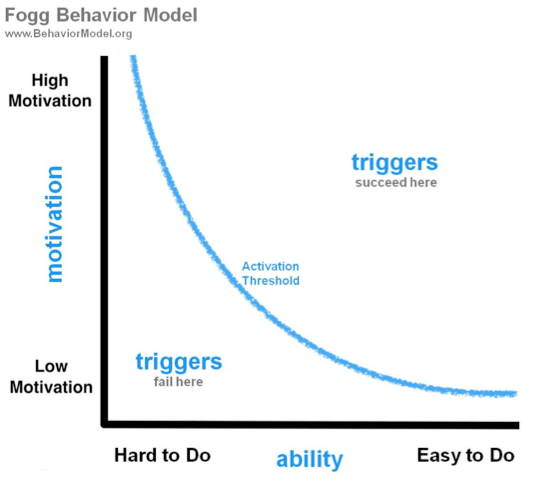

In recent years, behavioural scientists/economists have begun to undercover and understand the science of motivation. In particular, one scientist at Stanford has created a model for what is a the basis for people to take action. Dr. BJ Fogg founded the Persuasive Technology Lab at Stanford University, where he directs research and design. He created this model for which he calls the Fogg Behavior Model.

Engage Clients to Act

Essentially the Fogg-Behaviour Model talks about how there are 3 sets of criteria that must be in place in order for a behaviour to occur (i.e. clients taking an action on your recommendation.) These 3 criteria are:

- Motivation

- Ability

- Trigger

When the action doesn’t occur, it’s because one or more of the 3 criteria is missing.

On the graph of the spectrum of Dr. Fogg’s model, the higher the motivation of the person the easier it is when it is hard to do. For example, you know how easy it is to climb that mountain, be at your best for an interview at a company you love.

On the graph of the spectrum of Dr. Fogg’s model, the higher the motivation of the person the easier it is when it is hard to do. For example, you know how easy it is to climb that mountain, be at your best for an interview at a company you love.

Or let’s say you have a wonderful vacation with your significant other, you’d remember to wake up for it no matter what time in the night. It’s fairly simple to understand and we intrinsically know this.

But what’s interesting and also not surprising to know from Dr. Fogg’s research is that the lower the motivation, the action has be increasingly easy to accomplish. And in fact, when there is very little motivation, the triggers have to be very very easy to do.

Engage Clients to Act without Nagging

You can’t always get what you want, as they say. And one can’t always have the ideal client that listens to our very word and is always motivated. There needs to be some way to engage clients to get them to carry out their financial plan. In fact, they most likely wouldn’t have hired you if they didn’t need your support to help them understand and implement their plan.

So in order to engage clients to be better at executing on their plan, you need to make it easy (very very easy to do) for them. The most successful financial planners I know already do this in their practices and create a very easy-to-use summary of the plan actions. Taking this model, we know to make things easier, for them in the data gathering stage, but the most important part of motivating clients without nagging them during implementation is a need to make things simpler, easier for them to act on them. That’s the key to engage clients to act without constantly following up with them to the point of nagging.

If you’re interested in less nagging and in creating a Simple System for your Clients to engage them to action, sign up to learn more how MyPlanMap engage your clients now.